Table of Contents

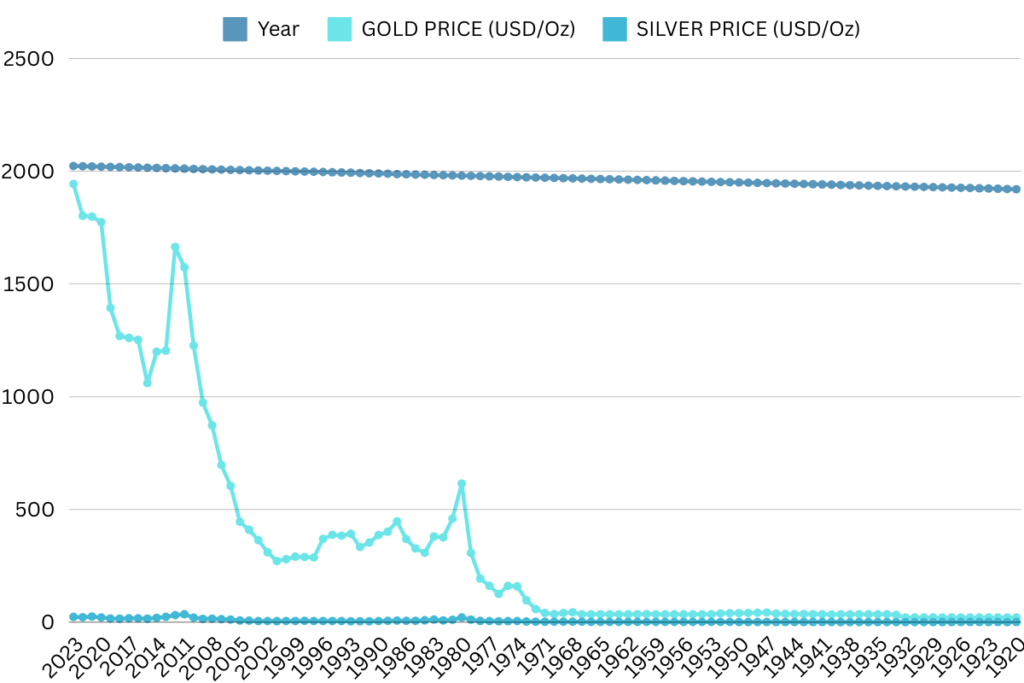

Start an exciting journey through the history of Gold and Silver Price History over the last 100 years. We’ll look at trends, economic factors, and investment insights that have shaped the precious metals markets since the early 1900s. This article is for both seasoned investors and those curious about these commodities’ long-term price movements.

| Year | GOLD PRICE (USD/Oz) | SILVER PRICE (USD/Oz) |

| 2023 | $1,943.00 | $23.40 |

| 2022 | $1,801.87 | $21.76 |

| 2021 | $1,798.89 | $25.14 |

| 2020 | $1,773.73 | $20.69 |

| 2019 | $1,393.34 | $16.22 |

| 2018 | $1,268.93 | $15.71 |

| 2017 | $1,260.39 | $17.07 |

| 2016 | $1,251.92 | $17.17 |

| 2015 | $1,060.00 | $15.66 |

| 2014 | $1,199.25 | $19.07 |

| 2013 | $1,204.50 | $23.79 |

| 2012 | $1,664.00 | $31.15 |

| 2011 | $1,573.16 | $35.12 |

| 2010 | $1,226.66 | $20.19 |

| 2009 | $973.66 | $14.67 |

| 2008 | $872.37 | $14.99 |

| 2007 | $696.43 | $13.38 |

| 2006 | $604.34 | $11.55 |

| 2005 | $444.99 | $7.31 |

| 2004 | $409.53 | $6.66 |

| 2003 | $363.83 | $4.88 |

| 2002 | $310.08 | $4.60 |

| 2001 | $271.19 | $4.37 |

| 2000 | $279.29 | $4.95 |

| 1999 | $290.25 | $5.22 |

| 1998 | $288.70 | $5.54 |

| 1997 | $287.05 | $4.90 |

| 1996 | $369.00 | $5.20 |

| 1995 | $387.00 | $5.20 |

| 1994 | $383.25 | $5.29 |

| 1993 | $391.75 | $4.31 |

| 1992 | $333.00 | $3.95 |

| 1991 | $353.15 | $4.06 |

| 1990 | $386.20 | $4.83 |

| 1989 | $401.00 | $5.50 |

| 1987 | $446.84 | $7.02 |

| 1986 | $368.20 | $5.47 |

| 1985 | $327.00 | $6.13 |

| 1984 | $308.00 | $8.15 |

| 1983 | $380.00 | $11.42 |

| 1982 | $376.11 | $7.92 |

| 1981 | $459.16 | $10.49 |

| 1980 | $614.75 | $20.98 |

| 1979 | $307.01 | $11.07 |

| 1978 | $193.57 | $5.42 |

| 1977 | $161.10 | $4.64 |

| 1976 | $124.80 | $4.35 |

| 1975 | $160.87 | $4.43 |

| 1974 | $158.76 | $4.67 |

| 1973 | $97.12 | $2.55 |

| 1972 | $58.17 | $1.68 |

| 1971 | $40.80 | $1.54 |

| 1970 | $35.96 | $1.77 |

| 1969 | $41.10 | $1.80 |

| 1968 | $43.50 | $2.00 |

| 1967 | $35.50 | $1.93 |

| 1966 | $35.40 | $1.29 |

| 1965 | $35.50 | $1.29 |

| 1964 | $35.35 | $1.29 |

| 1963 | $35.25 | $1.29 |

| 1962 | $35.35 | $1.29 |

| 1961 | $35.50 | $1.29 |

| 1960 | $36.50 | $0.91 |

| 1959 | $35.25 | $0.91 |

| 1958 | $35.25 | $0.91 |

| 1957 | $35.25 | $0.91 |

| 1956 | $35.20 | $0.91 |

| 1955 | $35.15 | $0.91 |

| 1954 | $35.25 | $0.91 |

| 1953 | $35.50 | $0.91 |

| 1952 | $38.70 | $0.91 |

| 1951 | $40.00 | $0.91 |

| 1950 | $40.25 | $0.71 |

| 1949 | $40.50 | $0.71 |

| 1948 | $42.00 | $0.71 |

| 1947 | $43.00 | $0.71 |

| 1946 | $38.25 | $0.71 |

| 1945 | $37.25 | $0.71 |

| 1944 | $36.25 | $0.71 |

| 1943 | $36.50 | $0.71 |

| 1942 | $35.50 | $0.71 |

| 1941 | $35.50 | $0.71 |

| 1940 | $34.50 | $0.71 |

| 1939 | $35.00 | $0.34 |

| 1938 | $35.00 | $0.43 |

| 1937 | $35.00 | $0.45 |

| 1936 | $35.00 | $0.45 |

| 1935 | $35.00 | $0.57 |

| 1934 | $35.00 | $0.48 |

| 1933 | $32.32 | $0.34 |

| 1932 | $20.67 | $0.28 |

| 1931 | $20.67 | $0.29 |

| 1930 | $20.67 | $0.50 |

| 1929 | $20.67 | $0.48 |

| 1928 | $20.67 | $0.58 |

| 1927 | $20.67 | $0.68 |

| 1926 | $20.67 | $0.68 |

| 1925 | $20.67 | $0.69 |

| 1924 | $20.67 | $0.63 |

| 1923 | $20.67 | $0.65 |

| 1922 | $20.67 | $0.64 |

| 1921 | $20.67 | $0.57 |

| 1920 | $20.67 | $0.64 |

A detailed and artistic representation of a graph showing the historical prices of gold and silver over the last century, featuring a harmonious blend of gold and silver tones, with intricate patterns symbolizing fluctuations in value, set against a textured background resembling aged parchment, highlighting the elegance and richness of precious metals.

In our exploration of gold and silver prices’ 100-year history, we’ll dive into the precious metals markets. We’ll analyze how economic factors have impacted these assets. We’ll also see how they act as an inflation hedge and look at long-term price trends.

Exploring the Gold And Silver Price History Over 100 Years

Gold and silver prices have changed a lot over the last 100 years. This change shows how the economy has grown and shifted. We’ll look at what has made their prices go up and down, and why they’re good against inflation.

The Influence of Economic Factors

Gold and silver prices are closely tied to the economy. When there’s uncertainty or high inflation, people buy more of these metals. This makes their prices go up. But, when interest rates go up, it’s harder to hold onto gold and silver because they don’t earn interest. This can make their prices fall.

Global events, politics, and how much is available and wanted also affect their prices. Knowing these factors helps us understand their past and predict their future.

Precious Metals as an Inflation Hedge

Gold and silver are popular because they protect against inflation. When prices rise, the value of money goes down. But, the value of gold and silver usually goes up. This helps keep the value of what investors own steady.

Because of this, gold and silver are great for keeping wealth safe and for diversifying investments, looking at their history shows how they’ve helped against inflation, making them key in the financial world.

| Year | Gold Price (USD/oz) | Silver Price (USD/oz) | Inflation Rate (%) |

|---|---|---|---|

| 1920 | 20.67 | 0.66 | 15.61% |

| 1940 | 35.00 | 0.71 | 0.70% |

| 1960 | 35.00 | 0.91 | 1.50% |

| 1980 | 612.56 | 20.64 | 13.50% |

| 2000 | 279.11 | 4.95 | 3.40% |

| 2020 | 1,895.10 | 26.49 | 1.40% |

The table shows gold and silver prices and inflation rates over 100 years. It shows how these metals have helped against inflation in tough times.

Analyzing Long-Term Price Trends

Understanding the precious metals market is key. We look at gold and silver’s history over a century. This helps us predict future prices.

Studying historical commodity pricing data is essential. We examine price charts and data to find patterns. This gives us a deep understanding of the market.

We also explore economic factors that affect gold and silver prices. Knowing these factors helps us make accurate predictions. This way, we can better understand the market.

Our goal is to create price forecasting models. These models help us predict future market movements. By studying long-term price trends, we can navigate the market better.

“The study of price history is the study of human nature itself.”

“An abstract representation of gold and silver price trends over the past century, featuring flowing curves that depict fluctuations, deep golden and silver hues blending with a vintage aesthetic, with visual elements like coins, bars, and charts subtly incorporated into a dynamic landscape.”

| Year | Gold Price (USD/oz) | Silver Price (USD/oz) |

|---|---|---|

| 1920 | 20.67 | 0.99 |

| 1930 | 20.67 | 0.38 |

| 1940 | 35.00 | 0.71 |

| 1950 | 35.00 | 0.90 |

| 1960 | 35.00 | 0.91 |

| 1970 | 35.00 | 1.94 |

| 1980 | 614.00 | 49.45 |

| 1990 | 383.55 | 4.82 |

| 2000 | 279.11 | 4.95 |

| 2010 | 1,224.52 | 20.19 |

| 2020 | 1,870.10 | 26.49 |

Conclusion

Exploring the 100-year history of gold and silver prices has given us key insights. These insights help us make better investment choices. They also guide us through the ever-changing precious metals markets.

We now understand how economic factors affect prices. We also see how precious metals protect against inflation. This knowledge helps us make smart decisions about these important assets.

Looking at long-term price trends, we’ve found patterns that help us invest wisely. This knowledge lets us predict market changes and find good opportunities. It also helps us protect our money, especially when the economy is uncertain.

With this knowledge, we’re ready to keep learning about gold and silver. We can make better choices and adjust to market changes. This way, we can benefit from gold and silver’s unique qualities as investments and inflation hedges.

FAQ

What is the history of gold and silver prices over the past 100 years?

Gold and silver prices have seen a lot over the last century. Economic factors have played a big role. We’ll look at the trends, cycles, and key moments that have shaped their values.

How have economic factors impacted the prices of gold and silver?

Economic factors like inflation and interest rates have greatly affected gold and silver prices. We’ll dive into how these factors have moved prices. And how they still influence the markets today.

Why are gold and silver considered inflation hedge assets?

Gold and silver are seen as safe investments against inflation and economic troubles. We’ll look at their past performance during high inflation times. And how they’ve protected investors’ wealth.

What are the long-term price trends for gold and silver?

We’ll study historical price charts to find long-term trends for gold and silver. This will help us spot patterns and turning points. It can guide our investment choices in the precious metals market.

Can we use price forecasting models to predict the future of gold and silver prices?

Predicting commodity prices is tough, but we’ll check out forecasting models. These tools can offer insights into gold and silver’s future prices. This knowledge can help us understand the risks and chances in the precious metals market.