In this article, we are going to tackle one of the biggest debates when it comes to investing in gold or buying physical gold What Is Better To Buy Gold Bars Or Coins? so let’s get into it.

Table of Contents

There isn’t truly a right answer to this question there are just trade-offs and some products are designed with specific features in mind to help maximize a specific benefit.

So What Is Better To Buy Gold Bars Or Coins which one is better this is one of those huge debates that people have gone on and on about because the most part the gold bars are always going to be cheaper than the gold coins. this might be twenty dollars cheaper or forty dollars cheaper depending on the coin but if you can buy them for less why would you not stack those exclusively why do people ever bother with gold coins I mean what is so special about them is it just because they were made by a government rather than a private mint. That can’t be the only reason right?

Who Gives More Value

It’s not much difference it’s not too difficult to find bars and coins with similar premiums however it’s much easier to find a 10-ounce gold bar than it is to find a 10-ounce gold coin in which case if you’re buying gold in large quantities you can get a break on the premium by buying a single town at 10-ounce bar versus 10 of the one-ounce coins.

some coins are part of a series that’s collectible and as the coin gets older and scarce or its value goes up some examples of gold coins that have gained additional premium after a few years include the swans graded Eagles and we looked up the price of a 2023 gold Swan for example is selling for about 150 more than the current year swans on several websites.

gold bars generally don’t have this kind of opportunity

What Is Better To Buy Gold Bars Or Coins: Three Factors

So let’s look at the top three reasons why people would pick one over the other

Trust

pick one over there is trust liquidity and price and then lastly there is personal preference but you can figure that one out for yourself.

let’s first talk about trust for some reason people think that there are more fake gold bars than fake gold coins out there on the market and they may or may not be right i guess it depends on where you live and where you’re actually buying them from.

fake gold bars are actually a little bit easier to make and yes they do make them in the assay cards they make them usually out of tungsten and then they plate them with gold so they’ll have the same specific gravity or at least really close to the same as gold but they’re not made out of gold.

They might also try and make them out of copper or some other metal but they’re going to be way too big and easier to detect they’ll probably be too thick so I guess if you’re really good at weeding out the fakes then it’s not really a problem but there are lots of fake gold coins out there as well

I think it’s a little bit easier to tell if a gold coin is fake compared to a gold bar. There are more tests that we can do on the gold coins.

How to check gold [Fake or Real]

You can look up the diameter and the thickness of any gold coin out there but gold bars come in all sorts of shapes and sizes so it can be a little bit more tricky to look up what size they should be

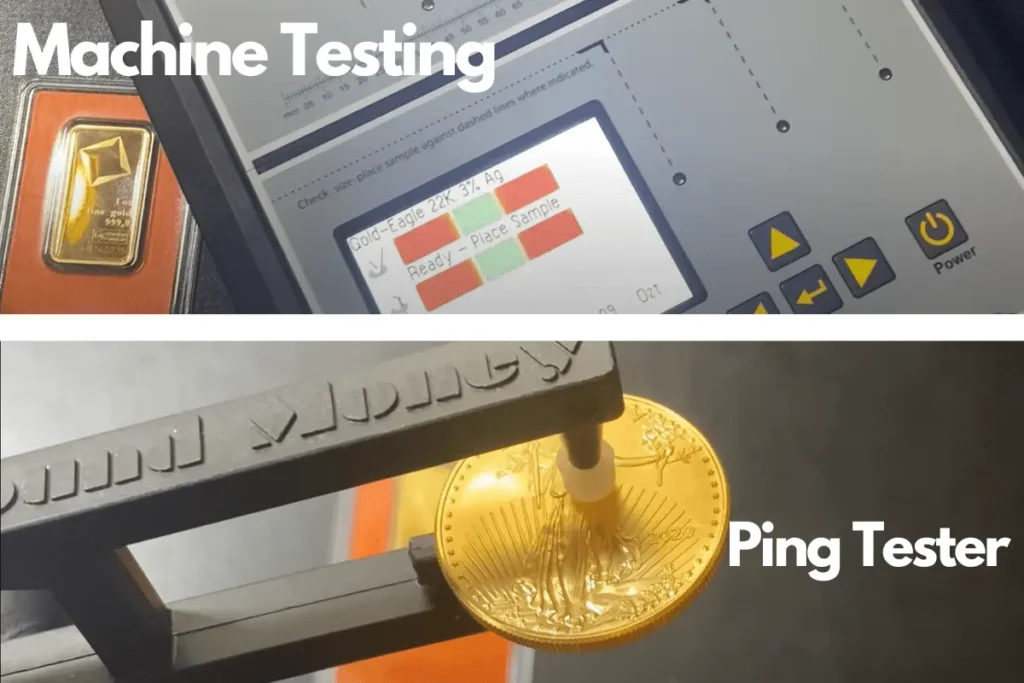

If you’re using a Sigma Metallics precious metals verifier then obviously it doesn’t matter you can test any size you can go into specific gravity.

If your coin shop has one of these machines or you have one of them then it doesn’t really matter as far as testing is concerned.

There is one test you can do on the coins but not on the bars and that is the ping test where you actually take the coin put it in (PING TESTER) little Leo you’ll hit It and listen to the sound you can tell if it’s real or fake based on the sound you can’t do that with the gold bars because for one you’d have to take them out of the assay card but two the ringing of a gold bar tells you nothing you won’t be able to tell if it’s real or fake it needs to be a circular coin.

Liquidity

I don’t know of any coin shop or bullion dealer that would refuse to take one or the other when it comes to bars or coins so you’re going to be able to offload them with no problem.

However, I do know that you will likely get less money for your bars which we will talk about when we cover the price but I wanted to bring up liquidity because you could be buying more than just American gold eagles you could be getting the Krugerrands you could be getting the American gold buffaloes you could be getting the Canadian maple leaves but most importantly you could be buying rare or numismatic gold coins like pre-33 gold for example.

I know this isn’t a full ounce but i did want to talk about the fact that when you go to sell your rare gold coins if you just take them down to a coin shop it’s going to be a little bit harder to offload them at the price you want they will make you some sort of an offer but if you paid a really high premium to obtain it you might have to wait for the gold price to go up significantly before you can actually recover that premium.

for that reason, i don’t recommend buying any rare gold coins unless you’re a collector you’re a pro stacker you know what you’re doing you know the value and you know where to sell them so if you’re worried about liquidity just stick with the popular stuff like the kangaroos, eagles, buffaloes, maples maybe the philharmonics you could also get the Britannia if you live in Australia then you have the kangaroos there are lots of popular options don’t go with the rare stuff.

Personal Preference & Price

The American gold eagle are one of my all-time favorites it was 18 dollars more for me to go with the eagles compared to the gold bars.

At the end of the day I had to ask myself what am I getting out of the American gold eagle I am getting the trust factor I’m getting the beauty of the coin as well so it kind of comes down to personal preference would you rather have the coins or the bars you are gonna spend a little bit more for the coins But in my opinion, it’s worth it.

The last important note is that there may be different reporting requirements the IRS requires at the time of sale between coins like gold Eagles or something like a generic gold bar. this is something to talk to your accountant about before making large purchases of Gold difference in how a Gold Eagle is taxed versus a generic gold bar could make a big difference.

For more in-depth information about gold IRAs, up to date Reviews of the top gold IRA companies

Conclusion

Investing in bars versus coins is something that should be determined by your personal goals and circumstances gold bars offer a certain amount of utility in that you can get products like Combi bars that are divisible or you can buy larger-size bars to get lower premiums meanwhile coins can have numismatic value and the popularity of mint coins makes it simple to liquidate and finally there may be some tax differences between bars and coins which is right for you will vary depending on why you’re buying gold in the first place.

View daily GOLD PRICE UPDATE